While we’re gearing up for Labor Day weekend, the economy certainly isn’t taking any days off. The bad: Last week’s jobs report was fairly abysmal. The better: Signs are pointing to the Fed cutting interest rates next month — for real this time.

The rate cut could mean a much-awaited shift in the housing market for buyers who’ve been eagerly waiting for a drop. While I’m not planning to buy a new house anytime soon, that won’t stop me from checking out places in the “hottest zip code” or wishing I could go back to college to live in one of these absolutely bananas sorority houses (yes, I got sucked into #bamarush too). Alternatively, there’s also this tiny house (maybe it qualifies for Prime shipping?). Ah, forget it. Maybe I’ll just move to Spain.

— Marisa Iallonardo, staff writer, White Plains, NY

for the group chat

The money stories everyone’s talking about.

The newest trend to take over your FYP: “Underconsumption core.” It could be helpful if you’re looking to spend less, stay on budget, and help the planet while you’re at it.

Log your PTO in Squiggler, check your pay stubs in KashKow, and utilize Clapback, Shoutler, and Bugle to communicate amongst teams. Enough already with the random apps at work.

When the White House wants to get a vibe check on how the cool kids are feeling about the economy, they turn to… their in-house “vibe-rarian.”

Having kids is already expensive, but some parents are readily going into “Disney debt.” Would you be willing to stretch yourself financially for this quintessential childhood vacation?

Fact or fiction? Having too many credit cards damages your credit score. This money and travel pro has thoughts.

Fill in the blank: The average cost of giving birth at a hospital in the U.S. is ____ ? Prepare for sticker shock.

P.S. Wake up to today’s most important stories right in your inbox by signing up for the Daily Skimm. Millions of your friends have already done it.

follow the money

How the news affects your finances.

Medical Debt Reaches Across Party Lines and Deep Into Pockets

When Vice President Kamala Harris presented her campaign’s economic plan last week, it included a stop to “price-gouging,” a first-time homebuyer subsidy, and an outline to relieve medical debt. An analysis from the nonprofit KFF says an estimated 20 million people, many of whom are women and Black Americans, have this type of debt looming over their financial future — with close to 3 million owing more than $10,000. And the consequences reach far beyond having to pay yet another bill.

Some types of medical debt can negatively affect your credit score, which could hurt your ability to buy a house, qualify for affordable car insurance, or even get a job, says Virgie Bright Ellington, MD, a former health insurance executive and author of What Your Doctor Wants You to Know to Crush Medical Debt. Plus, money stress from unpaid medical bills can deter people from going to the doctor in the future for fear of tacking on another high charge — which may lead to bigger (and more costly) health issues, says Bright Ellington.

But you have options. From negotiation tactics to lower-cost alternatives, here are a few expert tips that you can use right now (regardless of what happens in November) to cut down on payments and still prioritize your health.

Your Move:

Call your provider’s office and request an itemized bill with “CPT codes,” which help determine how much you’re charged, says Bright Ellington.

Review the codes to make sure there are no errors and you actually received those services.

Find the Medicare cost (this is the lowest price) for those services.

Use this research to get the bill fixed, negotiate a lesser amount, or set up a payment plan. Nonprofit hospitals are required to provide financial assistance, including sliding-scale income-based discounts, and many for-profit hospitals do the same, she says. You just have to ask. If the hospital isn’t budging, call your state’s health department to see if a representative can reach out to the hospital on your behalf, she adds. Or contact organizations like the Patient Advocate Foundation.

For those without insurance, explore using a direct primary care practice that allows you to pay a set monthly or yearly fee for certain services, or find a federally qualified health center, which uses a sliding-scale model.

who has a mentor at work?

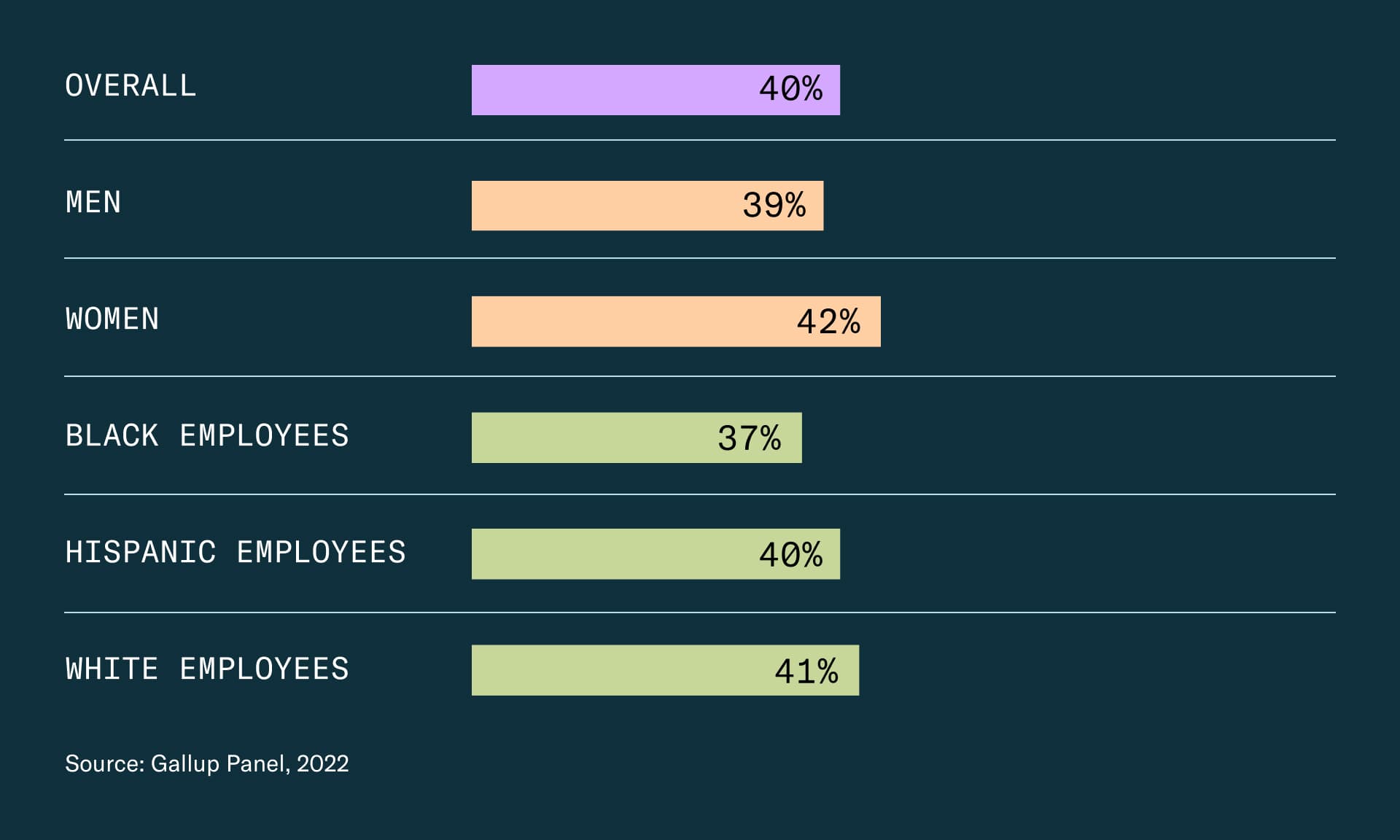

A recent study found that less than half of US employees have a mentor. Since that same study found that employees with mentors were twice as likely to strongly agree that they’ve had opportunities to learn and grow within the last year, it feels important to keep the mentorship flowing.

Merrill agrees. Mentorship is a key part of their Advisor Development Program, which combines expert-led coursework, high-tech immersive training, direct client interaction, and personal and professional support to help aspiring and early-stage financial professionals thrive. Participants also get help obtaining required licensing and certifications. In short: The bull has your back. Learn more and check out Advisor Development Program openings.

ask an expert

We asked you to vote on a question you’d like answered. The winner was:

What should I ask or look for regarding my employer’s maternity leave policy?

FEATURED EXPERT:

Akiko Thayer

founder of Maternity Leave 411 and certified leave management specialist

As if family planning weren’t complicated enough, figuring out your company’s parental leave policy can feel like building an IKEA changing table, blindfolded. “Unfortunately, even HR might not know all the details [of a family leave plan], especially if you work for a national company,” says Thayer. “That’s why it’s really important to [also] do your own research.” Here are four things you’ll want to look into as you financially prepare to welcome your addition. (Related: Everything You Need to Know About Maternity Leave in the U.S.)

What are the policies? Know what benefits your company offers, what the state offers, and what federal protections you have. The Family Medical Leave Act (FMLA) allows eligible workers to take 12 weeks of unpaid, job-protected leave. Some states also offer subsidized leave for certain life events. All of this is on top of whatever your employer offers.

Are you eligible? Employers may have eligibility criteria, like working at the company for a year, but this is something you can negotiate if you’re starting a new job. (P.S. Non-birthing parents should do this too.) (Related: I Applied for a Job at Six Months Pregnant. Here’s What I Learned)

Can you ease back in? Some companies allow for a gradual ramp up into full-time work. This could be working remotely or hybrid for the first few weeks, or working in a part-time capacity. (Related: Ramp-Up Policies for After Parental Leave)

Are there any extras? From subsidized child care to breastmilk shipping, some employers offer additional benefits for new parents. Also inquire about accommodations, like dedicated pumping rooms at the office. (Related: Employers Up Benefits for New Parents)

5-minute money tip

Kickstart your kids’ financial future

A Fabric by Gerber Life kids' investment account makes it easy for parents to give their kids a financial head start. You can also make penalty-free withdrawals at any time to use the money for expenses that benefit your kids, like tutoring, sports equipment, or art classes. Just contribute as little as $1 a day and watch the money grow with them. Psst...open an account by Sept 15 and get $25†. Learn more.

†Terms and conditions apply.

This is a paid endorsement for Fabric by Gerber Life’s UGMA (Uniform Gift For Minors Act) Offering and not a paid endorsement for advisory services. Investing in securities involves the risk of loss. Age of Majority varies by state. Please read the offering circular at meetfabric.com/UGMA.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.