The New Budgeting Hack: Have a "Normal House"

January is now in full swing, accompanied, as usual, by a parade of suggested aspirations. Budget better. Declutter. And of course, listen to the cleanfluencers convincing us that serenity lies in immaculate, color-coded pantries. But amid this noise, a refreshing trend is emerging: “normal houses.”

Across social media, at least, there’s a growing embrace of messy, sustainable, and attainable livability — sometimes branded “underconsumption core.” It’s a rejection of the Instagram-perfect aesthetic and a reminder that your home doesn’t need to look like a set design for a Scandi catalog.

Because let’s face it: even minimalism comes with expectations. Capsule wardrobes ironically require buying more things, just in neutrals. Decluttering often means investing in the “right” storage containers. As mortgage rates climb, inflation holds its ground, and your feed fills with January sales hauls, the message of the “normal house” is that it’s OK to just lean into what’s already working for you.

What actually makes life easier, less stressful, and more joyful? Embracing the things that have already brought you comfort and success, instead of constantly chasing what’s supposed to — and derailing your budget and savings rate in the process. Unless you make your living from creating home content, or Architectural Digest is in your living room taking photos, the main purpose of your home is not to be perceived. It's to give you shelter — physical, emotional, in many cases financial — while you pursue goals unrelated to wainscotting. Maybe 2025 will be the year we cling a little less to house-as-status and value the stained couch that doubles as a pet bed or the cabinet full of mismatched mugs. They’re doing what they’re there to do, so you can do the same.

— Packing a lot of personality into 500-square feet, Anna Davies, writer

PS: The California wildfires have left many without a place to call home. Here’s how you can help SoCal families rebuild theirs.

Read More

Your paycheck doesn’t determine whether or not you’ll become rich. Here’s the costly mistake that holds people across income levels back from building wealth.

If you’re dealing with the LA wildfires (or any other natural disaster), the last thing you need to worry about is your student loans. There are relief options available.

Attention anyone with medical debt: A new rule could mean good news for your credit score.

Sending payments is easy — until you accidentally send $500 to your friend’s name twin and can’t get it back. Enter: one government bureau trying to clean up the mess. Will there be Zelle to pay?

“Save more” sounds like a no-brainer resolution — but it’s easier said than done. Power your “richer in 2025” promise with these 50 strategies.

Looking for a new gig? Check out this list of the 25 fastest-growing jobs. Bonus: Many have remote or hybrid openings.

New president in the White House, new money moves for you. Consider this your pre-Trump 2.0 financial to-do list.

Q: My company just went through layoffs, and performance reviews are around the corner. I want to ask for a raise, but is now the right time — or should I keep my head down? — Big value, small paycheck

FEATURED EXPERT:

Just because your company has gone through layoffs doesn’t mean a raise or promotion is off the table, but timing and strategy are key. “It’s always important to have that discussion when things are not in any heightened state for you as an individual or the company,” says Bradford. Translation: Wait a few weeks until the dust settles post-layoff before making your move. Here’s your three-part strategy:

1. Assess the landscape. If the job market in your field is tight and your salary aligns with industry standards (check Glassdoor), it might not be the ideal time to ask. This is especially true if you already have great benefits, like work from home flexibility or comprehensive health coverage. (Related: How Much Will Salaries Increase in 2025?)

2. Tally your contributions. Highlight how your responsibilities have expanded and tie your work to measurable impacts like driving revenue or improving efficiencies. Create a doc to keep track of these; this can be helpful to share with your manager. (Related: How To Know When To Ask for a Raise)

3. Start the conversation. Set up a meeting and ask your manager for clarity: “My performance has been strong, and I’m taking on additional responsibilities. What do you see as my future here?” They may offer insight into the timing or feasibility of a raise. Even if they can’t give you the money right now, introducing the topic can let them know you’re thinking longterm. If they don’t bring the subject up again, bring it up in three months. (Related: How To Ask For a Pay Raise)

Tell Us

Would you ask for a raise after your company went through layoffs?

(This poll is no longer available)

Submit your money or work question for our panel of experts. Don't worry, it's anonymous.

Use the letters below to identify the word or phrase. Then, click to see the answer.

Clue: A professional who calculates risk using math, statistics, and financial theory. It’s also a surprisingly hot career choice, with employment poised to grow nearly 25% in the next 10 years.

Even More Smart Money Moves on Skimm+

Skimm+ is the membership that helps you seamlessly handle life's complexities, learn from Skimm'rs who have been there, and spend your money wisely with perks on services you already use.

Key membership features:

Databases with real numbers and honest intel on everything from daycare costs to self-employed salaries, sourced from Skimm'rs.

Scripts to help you handle tricky conversations, like negotiating a raise and navigating parental leave.

Live workshops and Q+As with our favorite experts.

Exclusive perks from brands you love.

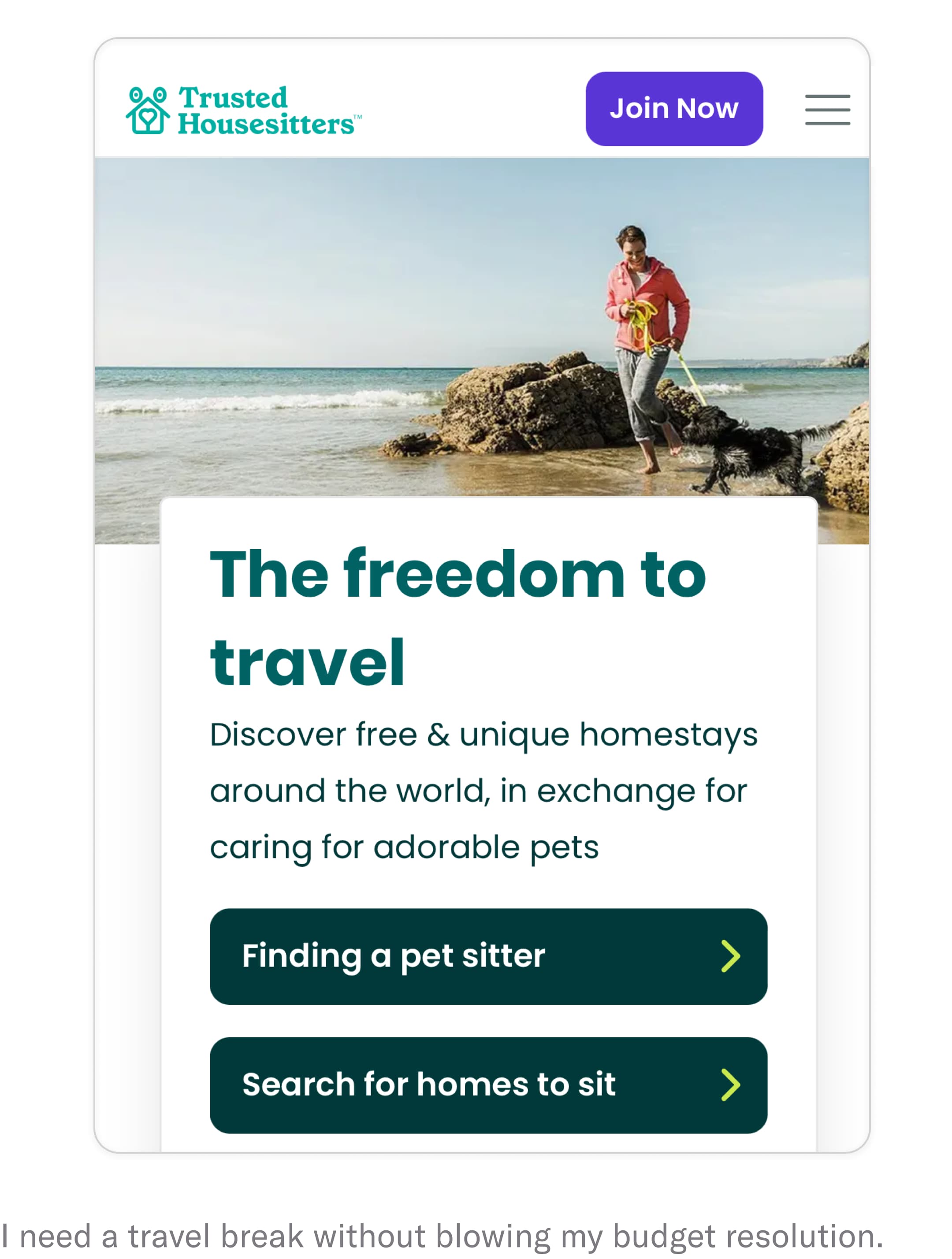

How I Scored an Almost-Free Long Weekend Getaway

What it is: TrustedHousesitters

What's cozier than a hotel and cheaper than Airbnb, with the added bonus of an adorable black cat named Bubbles? A stay courtesy of TrustedHousesitters. I recently used this app to arrange (almost) no-cost lodging for a long weekend in Philadelphia. My only duties between leisurely river walks, hours of thrifting, and squares of tomato pie were caring for — and of course cuddling — Bubbles. It went so well, I’ve done it two more times. In less than a year, the $149 annual membership fee has scored me 10 nights in a selection of charming, centrally located homes. It’s a great option to save money on travel — or even find some peace and quiet in your own zip code.

Key Features:

Flat annual fee lower than the price of many hotel rooms gets you unlimited access to global accommodations. (Good news for those allergic to animals: Some homeowners just need a sitter to look after their homes and plants.)

Match your away dates with the owners'. They'll approve your application, usually after a quick call or video chat.

Works both ways: For a little extra, you can find sitters to look after your own place.

Trending products and brands our shopping team has been loving recently.

Lest you believe all the good sales ended with Boxing Day, here's our guide to the best beginning-of-year sales to shop right now.

Amazon's running a sale on thousands of items that'll help you kick off the new year. Better workouts, deeper cleans, and less ordering in, here you come.

Brooklinen is offering 20% off comforters and pillows until January 20. We'll be buying this cozy duvet/quilt hybrid with a down alternative (read: not sneeze-inducing) filling.

Psst…love our recs? Follow @skimmshopping on Instagram for more products, gifts, and services that are actually worth the hype (and the price tag).

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.